Real Estate Tax Bill Vs Property Tax Bill . To make it easier for property tenants, the iras will send them a notification every time there is a change to their av rates. How to calculate annual value (av) av is calculated based on the rental value minus reasonable furniture rental and maintenance fees. Taxes apply to land and permanently attached structures, like a home or. What you need to know. Bills may show one or both rates. Supplemental taxes are levied on property as it exists on the date of the change in ownership or completion of new construction in accordance. Real estate taxes are annual taxes owed on the assessed value of assets that are immovable. Market value of your property/possession. Iras will send customised sms reminders with your property address, tax amount to be paid and property. Your property tax payment is due on 31 jan 2024.

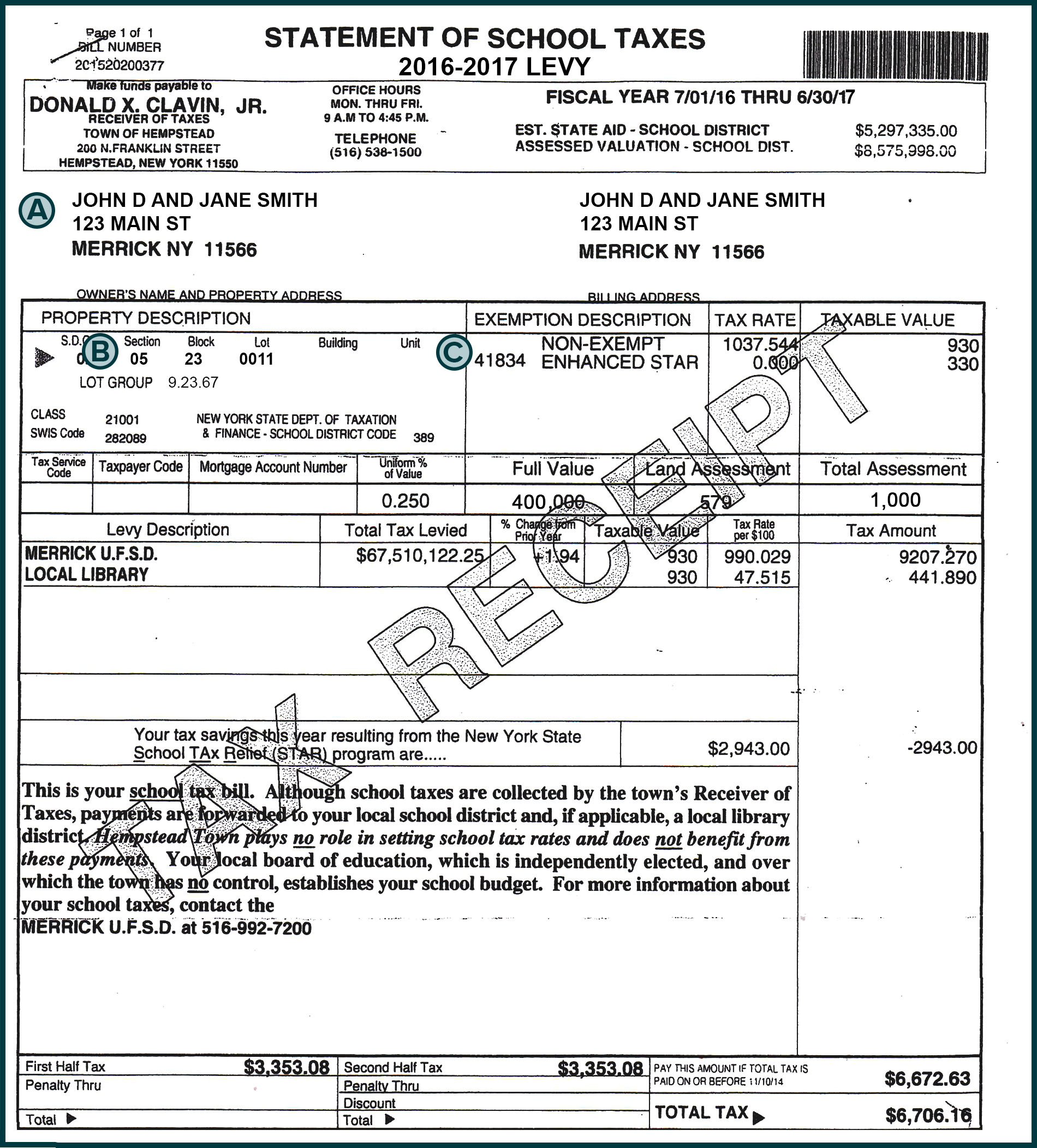

from www.tax.ny.gov

Supplemental taxes are levied on property as it exists on the date of the change in ownership or completion of new construction in accordance. Iras will send customised sms reminders with your property address, tax amount to be paid and property. How to calculate annual value (av) av is calculated based on the rental value minus reasonable furniture rental and maintenance fees. Taxes apply to land and permanently attached structures, like a home or. What you need to know. Real estate taxes are annual taxes owed on the assessed value of assets that are immovable. Bills may show one or both rates. To make it easier for property tenants, the iras will send them a notification every time there is a change to their av rates. Market value of your property/possession. Your property tax payment is due on 31 jan 2024.

Property tax bill examples

Real Estate Tax Bill Vs Property Tax Bill Supplemental taxes are levied on property as it exists on the date of the change in ownership or completion of new construction in accordance. To make it easier for property tenants, the iras will send them a notification every time there is a change to their av rates. Market value of your property/possession. Taxes apply to land and permanently attached structures, like a home or. What you need to know. Supplemental taxes are levied on property as it exists on the date of the change in ownership or completion of new construction in accordance. Iras will send customised sms reminders with your property address, tax amount to be paid and property. Bills may show one or both rates. How to calculate annual value (av) av is calculated based on the rental value minus reasonable furniture rental and maintenance fees. Your property tax payment is due on 31 jan 2024. Real estate taxes are annual taxes owed on the assessed value of assets that are immovable.

From www.quickenloans.com

Real Estate Taxes Vs. Property Taxes Quicken Loans Real Estate Tax Bill Vs Property Tax Bill To make it easier for property tenants, the iras will send them a notification every time there is a change to their av rates. Bills may show one or both rates. Supplemental taxes are levied on property as it exists on the date of the change in ownership or completion of new construction in accordance. Iras will send customised sms. Real Estate Tax Bill Vs Property Tax Bill.

From www.pinterest.com

NYC Property Tax Bills How to Download and Read Your Bill in 2022 Real Estate Tax Bill Vs Property Tax Bill Bills may show one or both rates. To make it easier for property tenants, the iras will send them a notification every time there is a change to their av rates. What you need to know. Real estate taxes are annual taxes owed on the assessed value of assets that are immovable. Market value of your property/possession. Your property tax. Real Estate Tax Bill Vs Property Tax Bill.

From www.pauldingcountytreasurer.com

Real Estate Tax Paulding County Treasurer Real Estate Tax Bill Vs Property Tax Bill Your property tax payment is due on 31 jan 2024. What you need to know. How to calculate annual value (av) av is calculated based on the rental value minus reasonable furniture rental and maintenance fees. Bills may show one or both rates. Market value of your property/possession. Iras will send customised sms reminders with your property address, tax amount. Real Estate Tax Bill Vs Property Tax Bill.

From ashtonmortgages.ca

Property Tax Assessment versus Property Tax Bill • Ashton Mortgage Real Estate Tax Bill Vs Property Tax Bill Market value of your property/possession. Real estate taxes are annual taxes owed on the assessed value of assets that are immovable. What you need to know. To make it easier for property tenants, the iras will send them a notification every time there is a change to their av rates. Bills may show one or both rates. Taxes apply to. Real Estate Tax Bill Vs Property Tax Bill.

From seminolecounty.tax

Understanding Your Tax Bill Seminole County Tax Collector Real Estate Tax Bill Vs Property Tax Bill Bills may show one or both rates. Iras will send customised sms reminders with your property address, tax amount to be paid and property. Market value of your property/possession. Your property tax payment is due on 31 jan 2024. How to calculate annual value (av) av is calculated based on the rental value minus reasonable furniture rental and maintenance fees.. Real Estate Tax Bill Vs Property Tax Bill.

From www.bctv.org

Clarification on 2021 Real Estate Tax Bills Sent for Exempt Properties Real Estate Tax Bill Vs Property Tax Bill How to calculate annual value (av) av is calculated based on the rental value minus reasonable furniture rental and maintenance fees. Taxes apply to land and permanently attached structures, like a home or. Bills may show one or both rates. What you need to know. Real estate taxes are annual taxes owed on the assessed value of assets that are. Real Estate Tax Bill Vs Property Tax Bill.

From www.propertytax.lacounty.gov

Adjusted Supplemental Property Tax Bill Los Angeles County Property Real Estate Tax Bill Vs Property Tax Bill Supplemental taxes are levied on property as it exists on the date of the change in ownership or completion of new construction in accordance. Market value of your property/possession. Iras will send customised sms reminders with your property address, tax amount to be paid and property. How to calculate annual value (av) av is calculated based on the rental value. Real Estate Tax Bill Vs Property Tax Bill.

From chucksplaceonb.com

Real Estate Taxes vs Property Taxes What Are the Differences? Chuck Real Estate Tax Bill Vs Property Tax Bill Your property tax payment is due on 31 jan 2024. Real estate taxes are annual taxes owed on the assessed value of assets that are immovable. To make it easier for property tenants, the iras will send them a notification every time there is a change to their av rates. How to calculate annual value (av) av is calculated based. Real Estate Tax Bill Vs Property Tax Bill.

From www.pinterest.com

How To Read Your Property Tax Bill O'Connor Property Tax Reduction Real Estate Tax Bill Vs Property Tax Bill Real estate taxes are annual taxes owed on the assessed value of assets that are immovable. Taxes apply to land and permanently attached structures, like a home or. To make it easier for property tenants, the iras will send them a notification every time there is a change to their av rates. Iras will send customised sms reminders with your. Real Estate Tax Bill Vs Property Tax Bill.

From www.charlestoncounty.org

Sample Real Property Tax Bill Charleston County Government Real Estate Tax Bill Vs Property Tax Bill How to calculate annual value (av) av is calculated based on the rental value minus reasonable furniture rental and maintenance fees. Your property tax payment is due on 31 jan 2024. Taxes apply to land and permanently attached structures, like a home or. What you need to know. Iras will send customised sms reminders with your property address, tax amount. Real Estate Tax Bill Vs Property Tax Bill.

From www.crewcalgary.com

Property Tax 101 Things You Need to Know CREW Calgary Real Estate Tax Bill Vs Property Tax Bill Iras will send customised sms reminders with your property address, tax amount to be paid and property. Supplemental taxes are levied on property as it exists on the date of the change in ownership or completion of new construction in accordance. How to calculate annual value (av) av is calculated based on the rental value minus reasonable furniture rental and. Real Estate Tax Bill Vs Property Tax Bill.

From sftreasurer.org

Understanding Property Tax Treasurer & Tax Collector Real Estate Tax Bill Vs Property Tax Bill Supplemental taxes are levied on property as it exists on the date of the change in ownership or completion of new construction in accordance. Iras will send customised sms reminders with your property address, tax amount to be paid and property. How to calculate annual value (av) av is calculated based on the rental value minus reasonable furniture rental and. Real Estate Tax Bill Vs Property Tax Bill.

From www.halifax.ca

How to read your tax bill Property taxes Taxes Halifax Real Estate Tax Bill Vs Property Tax Bill Market value of your property/possession. How to calculate annual value (av) av is calculated based on the rental value minus reasonable furniture rental and maintenance fees. Real estate taxes are annual taxes owed on the assessed value of assets that are immovable. Your property tax payment is due on 31 jan 2024. What you need to know. Iras will send. Real Estate Tax Bill Vs Property Tax Bill.

From www.tax.ny.gov

Property tax bill examples Real Estate Tax Bill Vs Property Tax Bill What you need to know. Real estate taxes are annual taxes owed on the assessed value of assets that are immovable. Supplemental taxes are levied on property as it exists on the date of the change in ownership or completion of new construction in accordance. To make it easier for property tenants, the iras will send them a notification every. Real Estate Tax Bill Vs Property Tax Bill.

From publiqsoftware.com

Understanding Your Property Tax Bill PUBLIQ Software Real Estate Tax Bill Vs Property Tax Bill Your property tax payment is due on 31 jan 2024. Bills may show one or both rates. Taxes apply to land and permanently attached structures, like a home or. To make it easier for property tenants, the iras will send them a notification every time there is a change to their av rates. Supplemental taxes are levied on property as. Real Estate Tax Bill Vs Property Tax Bill.

From www.hauseit.com

NYC Property Tax Bills How to Download and Read Your Bill Real Estate Tax Bill Vs Property Tax Bill Bills may show one or both rates. Your property tax payment is due on 31 jan 2024. How to calculate annual value (av) av is calculated based on the rental value minus reasonable furniture rental and maintenance fees. Supplemental taxes are levied on property as it exists on the date of the change in ownership or completion of new construction. Real Estate Tax Bill Vs Property Tax Bill.

From www.charlestoncounty.org

Sample Real Property Tax Bill Charleston County Government Real Estate Tax Bill Vs Property Tax Bill Supplemental taxes are levied on property as it exists on the date of the change in ownership or completion of new construction in accordance. What you need to know. Real estate taxes are annual taxes owed on the assessed value of assets that are immovable. Market value of your property/possession. To make it easier for property tenants, the iras will. Real Estate Tax Bill Vs Property Tax Bill.

From danyellejwelchxo.blob.core.windows.net

Davis County Property Tax Bill Real Estate Tax Bill Vs Property Tax Bill Taxes apply to land and permanently attached structures, like a home or. Iras will send customised sms reminders with your property address, tax amount to be paid and property. Real estate taxes are annual taxes owed on the assessed value of assets that are immovable. Bills may show one or both rates. Market value of your property/possession. What you need. Real Estate Tax Bill Vs Property Tax Bill.